AMAZON Exposed – How Does Amazon Really Make Money?

Investors love to chat about Amazon’s ever-growing e-commerce business. The Corporation stands out among giant U.S. Corporations as the largest online retailing platform. Its growth in terms of customer base and revenue continues to increase year after year, as it adds new sellers to its platform. The Corporation’s competitive position in retail and technology has always been a reflection of the brand. Even after the Covid-19 pandemic hit, Amazon remains among the wealthiest companies in the U.S.

_BUT, HOW DOES AMAZON MAKE MONEY? _Unfortunately, most people only think of e-commerce when they think of Amazon, but are sales the only way they generate money?

Part One: The AMAZON Business Model

July 5th 1994 Jeff Bezos Leaves Wall Street

On Wall street He Learns From His Mentor “Data = You Win”

GOAL: 1,000,000 Cataloged Items For Sale

BUT: Before Making Its First $1 In Profit… Some Setbacks

Sued By Barnes And Noble 1997

Sued By Walmart 1998

Some Interesting Timeline Events

1998 Amazon Acquires IMDB

1999 Amazon Patents “One Click” Ordering

1999 Amazon Launches 3rd Party Selling

Today – 60% Of Sales From Third Party Sellers

HINT: They Get ALL The Customers And ALL The DATA!

2003 Amazon Launches a9.com Search And Advertising Technology

2003 Amazon Launches AWS Hosting

DECEMBER 2003 – FIRST PROFIT ANNOUNCED

2005 Amazon PRIME

2006 Amazon S3 Servers

2007 Amazon Digital Music

2010 Kindle Book Sales Surpass Physical

2011 Amazon Instant Video

2012 Amazon Acquires KIVA Robots

2013 Amazon Acquires GoodReads

2014 Amazon Echo

2018 Cashier-less Grocery Store

2018 $15 Minimum Wage

So What Is Amazon’s Actual Business Model?

Customer Tracking And Massive Amounts Of Data

Other than its e-commerce operations, the international retailer has been running several operations. It doubles up as a cloud service provider, shopping giant, and device maker. It also does digital advertising, offering cloud services, sale of groceries, and drug prescription. Furthermore, they also offer the sale of A.I.’s such as Alexa, and sale of televisions and movies through its Prime Video platform.

“Alexa” is often mentioned when the Company releases its quarterly and yearly figures. Sadly, they do not break out the earning from the voice assistant in their reports.

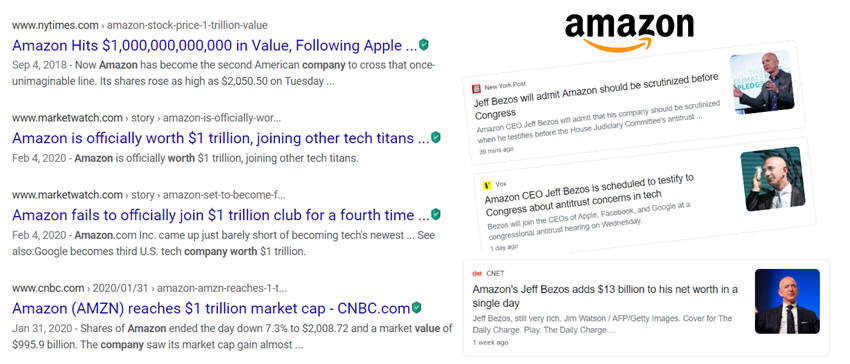

Amazon’s Financial Position

The largest online retailer has always ranked at the top of the market. As of 5th December 2019, it has a total market cap of $867.4 billion. The Corporation’s net income has been tripling over the fiscal years. For instance, the operating income in 2018 was $12.4 Billion, a 202% increase from 2017, which was $4.1Billion. During Q1 of 2020, the operating income dropped to $3.989 billion from $4.420 billion- a 9.8% decline.

In April 2020, the tech giants reported its revenues for the first quarter of the year. The first fiscal quarter recorded $75.5 billion in revenue with a $2.5 net income and $5.01 earnings per share.

The figures keep rising, but how does amazon make money? The best way to figure out how the Corporation generates revenue is by following the money.

Amazon’s Business Model

The Corporation remains the most massive selling and buying market place across the globe. Despite the U.S. representing the Corporation’s primary source of income, it continues to expand, and so does its sale of services. When looking into the operating income, the Corporation’s growth is attributed to the high sale of services.

REGIONS SEGMENTS

The Company has divided its operations into three main segments;

* North America

* International

* AWS

The first two divisions- North America and International refer to geographical operating zones. These are the regions where the Corporation mainly carries out its retail business. Thus, these two are the source of revenue originating from retail sales.

1. Retail Sales

Amazon is a world retailer. It offers consumer products both from their physical and online stores. Like any other business, they realize revenue when the customer buys from them. As for selling online, the international retailer also serves as the primary delivery agent. Thus, it is its duty to ensure the product reaches the consumer-making the first source of income retail sales.

In relation to retail sales, there are two business segments- North America and International segments. Retail can be further subdivided into physical stores, online stores, and bulk selling. Sales coming from online stores remain the base of the Corporation’s business. Though, it still is the slowest growing segment.

Let us take a more in-depth look into the two segments;

NORTH AMERICA

It is the largest reportable segment of Amazon’s operation. It has always accounted for the most significant proportion of the annual net revenue for the Company. Hence, the most significant source of sales income.

Figures from 2018 and 2019 show that the North America segment brought in as much as 61% of the total net sales. This year, the North America segment sales were up to $46.1 billion (29%). The high figures are due to the increase in unit sales of both products and services in the online marketplace.

Other than retail, North America is also a high source of income when it comes to buying subscriptions. There is a high demand for Amazon Prime subscriptions due to the offers that come with it. That is unlimited free shipping and streaming T.V.s shows, movies, etc.

Though, compared to other segments, North America has been slowly growing Year over Year.

INTERNATIONAL

This is the second-largest reportable business segment after North America. The international sector mainly contributes to money earned from consumer products and online provisions in other stores. International regions include the U.S., Mexico, and Canada, etc.

This year’s international sales for the first quarter have grown by 18% to a total of $19.1 billion. They are therefore accounting for 25.3% of the total net sales. Unfortunately, the international segment has not been thriving as much as North America.

This section includes Amazon sales and retail businesses across the world. Therefore, it falls under the online store section. International sales are also inclusive of export sales from online stores, excluding those from North America. Over the last three years, the international segment has resulted in the Corporation losing money.

2. Amazon Web Services ( AWS)

Though recently launched in 2006, AWS has been recording high margins and profit growth over the past years. Amazon Web Services serves government agencies, businesses, and academic institutions. It gives them a platform to store their information and deliver the needed content safely.

The Company refers to them as an extensive set of global communication, storage database. Shockingly, AWS has generated high sales, with its profits growth over the last three years. For the Fiscal Year of 2018, this segment contributed total net sales of $25.7 billion, which is $7.3 billion more from that it recorded in 2017.

In the next year, 2019, AWS generated $35 billion, a 22% increase from 2018. In the first quarter of 2020, AWS recorded a $10.219 billion revenue, a 32.8% rise from 2019.

The increase in revenue was due to the rise in demand for web services by customers across the world. As Amazon reduced the prizes for its customers, more people bought it. Therefore, the revenues are expected to rise as the Corporation works on lowering the price for its customers.

The net sale from the web provision is far below what the Corporation gets from North America. However, both segments once came close to generating almost the same income in 2018 when AWS recorded an operating income of 50.1%, as North America recorded 49.9%. As of 2018, Amazon controlled almost two-thirds of the cloud market. The main competitor under this stream of revenue is MSFT- Microsoft’s Corps Azure and GOOGL- Google Cloud.

3. Advertising

Among the most recent initiatives by the Company has been venturing into advertising. Thus, attracting rivals such as Google and Facebook. By offering advertising, Amazon significantly helps promote products sold by third-parties, both working in or outside their platform.

Compared to its competitors, international retailers have an added advantage. They can provide their retailer with a considerable ROI- return on investment. This is because the retailer is already widely known as a shopping hub. The Company groups their advertising sales figures as well as other undisclosed services during their annual report. Therefore, it is quite challenging to assess whether the advertising sector is growing or failing directly. However, it has higher margins compared to online and physical stores.

Nonetheless, advertising has been fast-growing and brings in a significant proportion of revenue- especially. This is mainly because the Company has excellent infrastructure and is widely known. Thus, more entrepreneurs and marketers are willing to pay for their advertising services.

When releasing the earnings for the last quarter of 2019, Olvasky, the CFO, said that it was still early. However, they were still using machine learning to come up with better relevancy. The release of the revenue for the first quarter of 2020 shows the advertising business has been up by 44% to $3.91 billion. During the earnings call, the CFO mentioned that he had noticed some pullbacks from their advertisers. Thus a downward pressure in terms of pricing.

On the brighter side, it wasn’t as noticeable. So, he mentioned it to be some kind of mixed-up bag. He was also clear when he said that a significant proportion of the Company’s advertising related to their sales, and not to auto off-sites.

Also, he mentioned that the advertising could have been negatively affected by the COVID-19 crisis.

WHY AMAZON’S ADVERTISING STANDS OUT

First, the Corporation allows advertisers to take advantage of the one-click buying. Thus, it increases conversion rates as opposed to competing for third-part ad platforms such as Google. Second, the Company’s success results from their focused intent. People always visit the site when they are ready to buy things.

Take an example of someone who sees an ad on Instagram or YouTube. They have just gone there in search of entertainment, and not to buy. Then compare that to someone who goes to their site and see a pop-up ad for something on sale. You are already half-way to buying it because you visited the platform with an intent to purchase.

4. THIRD-PARTY SELLER SERVICES

Apart from the revenue from both physical and online stores, the giant Company also makes a lot from third-party sellers. These are sellers who fulfill customer orders by selling their products. Thus, in these cases, Amazon is not a direct seller.

These services include commissions, fulfillment fees, shipping, among others relating to its online shopping. They are paid for whenever a seller renders their services uses the platform.

So, while the sales may not grow exponentially, the Corporation’s ecosystem-related revenue continues to rise. For instance, in 2018, the third-party sector contributed $42.75 billion and $53.8 billion in 2019.

5. Smart home security

Unknown to many, the mighty Corporation also owns Ring Company. A Company which provides smart home security products and services. The Corporation is going big by marketing the security system to consumers and the police departments and local government.

6. Subscription services

Another way through which the e-commerce and tech Company earns is through their subscription services. The sale of subscriptions is inclusive of fees that unlock access to content such as audiobooks and eBooks. For instance, Amazon Prime, the renowned subscription plan, plays a massive role in corporate businesses. The membership program has two methods- monthly at $12.99 and yearly at $119.

People buy the prime membership plan to enjoy more products and services. Besides, the service comes with a one-day free trial and even same day delivery. Currently, their Prime subscription has more than 150 million members. In 2019, these subscriptions generated $19.2 billion, which is $5 billion more than the $14.2 billion revenue from 2018. During the first quarter of 2020, subscriptions and ads jointly rose to $5.56 billion. Thus a 28% rise.

Other than bringing in revenue, it also creates a dependable and predictable source of income. Also, it makes their customers more loyal. Like we earlier said, the primary source of income for the Company comes from the sale of services. As such, it is slowing moving toward the purchase of services.

If you focus on infographics, you must be seeing high numbers coming from the sale of products. So you are probably wondering why the giant Company would resort to shifting to the provision of services rather than selling of goods. Yes, most revenue comes from selling products. However, products also attract high expenses, which make their margins thin.

7. Amazon Virtuous cycle

In 2001, Jeff Bezos sketched a flywheel, which has become the marketing strategy for the Corporation. The virtuous cycle is a strategy that begins from consumer experience in an attempt to bring in more traffic to the Company. The traffic is then monetized by the selection of products and third-party invitations.

The cycle improves the choice of goods and services, which would otherwise take years to select. It also improves the customer experience and acts as a source of income. Money generated through monetization of traffic helps improve the cost structure, thus, instead of distributing the additional funds to shareholders. The Company passes it to consumers through lower prices of products and services.

AMAZON’S GEOGRAPHICAL SEGMENTS

The Company has divided its business area into five segments according to their geographical locations. Four of the five segments are the Corporations leading markets, and the fifth refers to the “other” markets. The first market in the United States, which is the leading market. It is then followed by Germany, the United Kingdom, and then Japan. There are four top geographical segments. The fifth is labeled as the rest of the world.

During the fiscal year 2019, the U.S. generated as much as $193.64 billion (69%) of the total net revenue of the Company. Germany accounted for $22,23 billion while the U.K. contributed $17.53 billion. Japan generated $16 billion as the rest of the world generated $31 billion.

COVID-19 IMPACT

During the first quarter of 2020, the Company had a 26.3% increase in revenue and a 9.7% decrease in its operating income. The high cost of operation is attributed to high sales(as much as 30% higher) due to COVID-19. The pandemic led to an increase in both shipping and fulfillment costs and increased marketing expenses.

During the Corona Virus pandemic, the Corporation has recorded a significant increase in revenue. As a result, there has been more cash from other operating activities (because it has positive conversion cycles). The money generated was, however, spent on expanding on shipping and fulfillment. It was also spent on investing more in its tech platform- AWS.

The CEO, Jeff Bezos, provided a comprehensive state during the pandemic. He said the business state has never been more critical than it was. He then addresses the investors directly on the $4 billion. Of the $4 billion, $300 would be spent to develop the companies coronavirus testing capabilities. The CFO, Brian Olsavky, said, “We intent to put our best personnel on it. And I think everyone will be tested.”

From the statement made by the officials, they intend to spend money, but not to generate more or to make a profit. But as a response to the pandemic. Unfortunately, this type of news doesn’t excite investors. And as a result, their stocks went down.

Still, in relation to Covid-19, the Corporation further intends to procure 100 million face masks. The masks are to be put on by their employees, starting from the associates, drivers, and the support staff.

The Corporation also spent a significant amount on more than 31,000 thermometers and 1,000 thermal cameras. This equipment is to be used to carry out the daily mandatory temperature checks.

AWS AS A $10 BILLION BUSINESS

AWS is one of the most significant sources of revenue for the Corporation. It passes the $10 billion milestones during Q1 in 2019. During Q2, its growth fell to 37% from 40%. Its growth further declined during the Q3 to 35% and further down to 34% in the fourth quarter.

During Q1, 2020, the sector has further slipped to 33%. Showing that Covid-19 may have impacted some change to the ongoing trend. However, when the results of the Q2 are out, we shall be sure.

AWS is now a cloud computing services leader. Its high percentage of growth cannot remain unchanged. The increase of 33% in sales, leading to revenue worth $10.2 billion, is not a big deal. During the first quarter of the year, the cloud computing services resulted in as much as 13,5% of the total Corporations earning in the quarter.

RECENT DEVELOPMENTS IN THE COMPANY

AWS remains the latest business taken up by Amazon and included in the U.S. anti-probe trust. Other developments include the fact that the Company has faced high regulatory scrutiny from the Federal Trade Commission. However, it is a routine check as the FTC is responsible for conducting antitrust investigations into major tech or e-commerce companies.

Since their Web Services are slowly dominating the cloud market, the FTC investigation aims to determine if the Company is unjustly favoring software companies that have partnered with it at the expense of its competitors. Therefore, the giant international Company is under high pressure from its customers, employees, and other unions. The main focus is on their employment policies as well as current compensation policies.

This is evident from the protest which happened last year during Black Friday. On Black Friday, when the Company sells highly due to the high discounts offered. Unfortunately, the Company workers from Europe took on to protest citing unfair working conditions.

WRAPPING UP!

Amazon has been an international tech giant for years now. Though it started as a bookstore, it is now the world’s largest marketplace. You can get anything within your imagination there. Unknown to many, there are numerous ways through which the Company makes money apart from sales. Our article above comprehensively answers the question, “how does amazon make money.”

With numerous exemplary performing businesses operating at an international scale, you can expect the Corporation to continue rising. Rather than solely relying on retail sales, Amazon has diversified its source of income by adjusting its business model. Thus, the sale of services such as web services, subscriptions, and digital advertising are primary sources of revenue. Unlike the sale of products, they don’t have a high operating cost. Thus higher margins compared to the sale of products.

Therefore, when analyzing the numbers, don’t be fooled by the revenues. Focus more on business models. The most impressive part of their business plan is how different segments blend and work together. For instance, their advertising services attract online sales, which in turn propels their subscription business, and finally drives their physical store sales. Thus, all their customer business works in line to contribute to higher sales and hence higher revenue.

The two major rival businesses are Google and Facebook. These two companies have been trying to mimic Amazon’s shopping experience to no avail. Their efforts don’t result in higher revenues. Thus, the giant eCommerce and tech company still maintains the upper hand when it comes to user intent and conversion rates.

SOURCES:

https://www.investopedia.com/how-amazon-makes-money-4587523

https://www.pcmag.com/news/how-amazon-makes-its-money

https://www.investopedia.com/articles/investing/011316/what-amazon-web-services-and-why-it-so-successful.asp

www.businessinsider.com/amazon-earnings-aws-amazon-web-services-10-billion-quarterly-revenue-2020-4

Part Two: How Money Is Made In Real-time

112 Million Amazon Prime Members

$10 Billion Dollars From Prime Fees

Most Successful Membership Platform Ever!

Obviously Amazon Makes Money From Thier Products And Services Sold

2% Ad Services And Credit Card Agreements

5% Amazon Prime And Other Subscriptions

9% AWS Amazon Web Services And Hosting

17% Third Party Sellers

67% Amazon Retail Sales

Its All About The Invisible Infrastructure

The Retail Platform That Gets The Data

Some Key Business Takeaways From Amazon Employees, Reps, And Execs

“Data To Predict – Our Site Is A Laboratory”

“Customer Behavior Data Collection”

TRACK EVERYTHING, Clicks, Pause, Add To Cart, Leave, Hover, Ect.

“I Was Shocked At How Predictable People Really Are”

Free Two Day Shipping Keeps You Buying

Willingness To Experiment – Keep Getting A Little Better

Part Three: What Happens Behind The Curtain

Watching, Learning, Testing, Improving, Wanting To Know What You Want Before You Know You Want It

Part Four: Five Ways To Earn With What You Learned Today

1. Sell Stuff On Amazon FBA

2. Become An Amazon Affiliate (payouts suck)

3. Write Books For Kindle And Amazon

4. Take What You Learned And Make Your Own Website / Blog

5. Create A Membership Site Designed To Sell Other Stuff

Comment Below What Company You Want Me To EXPOSE Next

Seriously!! Such an Amazing sharing!

Looking forward to crush Affiliate Market with your technique!

Focus Focus Focus!