High Ticket Affiliate Marketing Scams

The Webinar Is Saturday At 3PM Eastern Time

Click Here To Register For The Affiliate Hangout

“If you’re curious or have been wondering how to start your own online business from scratch, then you’ve got to see the video with Dave on the next page.”

https://www.ftc.gov/news-events/news/press-releases/2018/02/ftc-obtains-court-order-halting-business-coaching-scheme

Terms match |

|||

|---|---|---|---|

|

legendary marketer scam

|

1.4K | ||

|

is legendary marketer a scam

|

200 | ||

|

legendary marketer scam reddit

|

20 | ||

Unmasking Pyramid Schemes, Ensuring Consumer Protection, and Promoting Informed Choices

I. Introduction to Pyramid Schemes

A. Definition and Characteristics

In the vast realm of business ventures, pyramid schemes are deceptive structures that promise financial success through a dubious formula. At their core, these schemes prioritize recruitment over genuine product sales or services. Participants are enticed by the allure of exponential earnings, often tied to recruiting new members.

The key characteristics defining pyramid schemes include:

- Recruitment Focus: The foundation of pyramid schemes is built on a relentless pursuit of new participants. Individuals are urged to recruit others into the scheme, creating layers resembling a pyramid. The emphasis on recruitment precedes the actual sale of tangible products or services.

- Lack of Tangible Product: Pyramid schemes often operate without a legitimate product or service. In cases where a product exists, it is typically of little value and serves as a smokescreen to conceal the underlying recruitment-centric structure.

- Unsustainable Financial Models: The inherent flaw in pyramid schemes lies in their financial models. The structure is designed to promise lucrative returns based on recruitment, creating an unsustainable dynamic. As the pyramid expands, reaching a point of critical mass becomes unattainable, leading to the collapse of the entire scheme.

- Consumer Risks and Losses: Enticed by the prospects of easy wealth, participants often face substantial financial losses. The pyramid’s inevitable collapse leaves those lower in the hierarchy with dwindling prospects, while a small fraction at the top benefits disproportionately.

B. Illegal Nature and Deception Involved

Pyramid schemes operate in a shadowy realm, exploiting the dreams of individuals seeking financial independence. The deceptive nature of these schemes is inherently illegal and often involves a web of tactics designed to mislead participants. The key elements encompassing the illegal nature of pyramid schemes include:

- False Income Promises: Participants are lured in with promises of extravagant earnings, often with minimal effort or investment. These income claims, however, are unfounded and serve as bait to attract unsuspecting individuals.

- Manipulative Marketing Tactics: Pyramid schemes employ manipulative marketing strategies to create a false sense of urgency and exclusivity. This may involve high-pressure sales tactics, emotional manipulation, or the use of charismatic leaders to cultivate trust.

- Ponzi-Like Structure: The resemblance to a Ponzi scheme is inherent in many pyramid schemes. Both share the characteristic of using funds from new investors to pay returns to earlier investors, creating a cycle of dependence that inevitably collapses.

- Legal Consequences: Pyramid schemes face legal consequences due to their deceptive practices. Government authorities, such as the Federal Trade Commission (FTC), actively pursue these schemes to protect consumers from financial exploitation. Legal actions may include fines, shutdowns, and penalties against individuals orchestrating or promoting pyramid schemes.

- Undermining Financial Trust: Beyond legal ramifications, pyramid schemes erode the foundation of financial trust within communities. As participants suffer losses, trust in legitimate business opportunities diminishes, creating a ripple effect beyond individual victims.

The illegal nature of pyramid schemes resides in the intentional deception of participants, the unsustainable financial models they employ, and the irreparable harm they cause to individuals’ economic well-being. Recognizing these characteristics is pivotal for individuals to shield themselves from falling prey to the seductive allure of pyramid schemes.

II. MOBE (My Online Business Education)

https://www.ftc.gov/legal-library/browse/cases-proceedings/172-3072-mobe-ltd-et-al

A. Background and Founders

Background: My Online Business Education (MOBE) emerged on the online business education scene, presenting itself as a platform for individuals seeking to carve a path to entrepreneurial success. Founded by Australian entrepreneur Matt Lloyd in 2011, MOBE positioned itself as a comprehensive educational resource, promising to guide members through the intricacies of online business and wealth creation.

Founders:

- Matt Lloyd: The visionary behind MOBE, Matt Lloyd, started his entrepreneurial journey early in life. Before MOBE, he had experience in the affiliate marketing space, which shaped MOBE’s business model.

B. Business Model Overview

MOBE’s business model was intricately woven with a focus on high-ticket sales and recruitment, raising eyebrows within the online business education community. Participants were encouraged to invest substantial sums to access various membership levels, each promising a step closer to financial prosperity.

Vital Elements of MOBE’s Business Model:

- Tiered Memberships: MOBE operated on a tiered membership structure, each level unlocking purportedly advanced training and income opportunities.

- Upselling Tactics: Participants were often exposed to aggressive upselling tactics, pushing them to invest more money in pursuit of higher earnings and exclusive benefits.

- Focus on Recruitment: While ostensibly an educational platform, MOBE’s emphasis on recruitment over genuine product sales underscored its alignment with the characteristics of a pyramid scheme.

C. Operation Methods

Recruitment-Centric Strategy: MOBE’s operation methods were notably recruitment-centric. Participants were incentivized to recruit new members into the system, and the compensation structure heavily rewarded those who successfully brought in new enrollees. This focus on recruitment over the delivery of tangible products or valuable services echoed the hallmark traits of a pyramid scheme.

High-Pressure Sales Tactics: MOBE employed high-pressure sales tactics in its promotional efforts. Participants and potential recruits were subjected to persuasive marketing strategies that often downplayed the risks and emphasized the potential for substantial financial gains.

D. FTC Actions and Legal Consequences

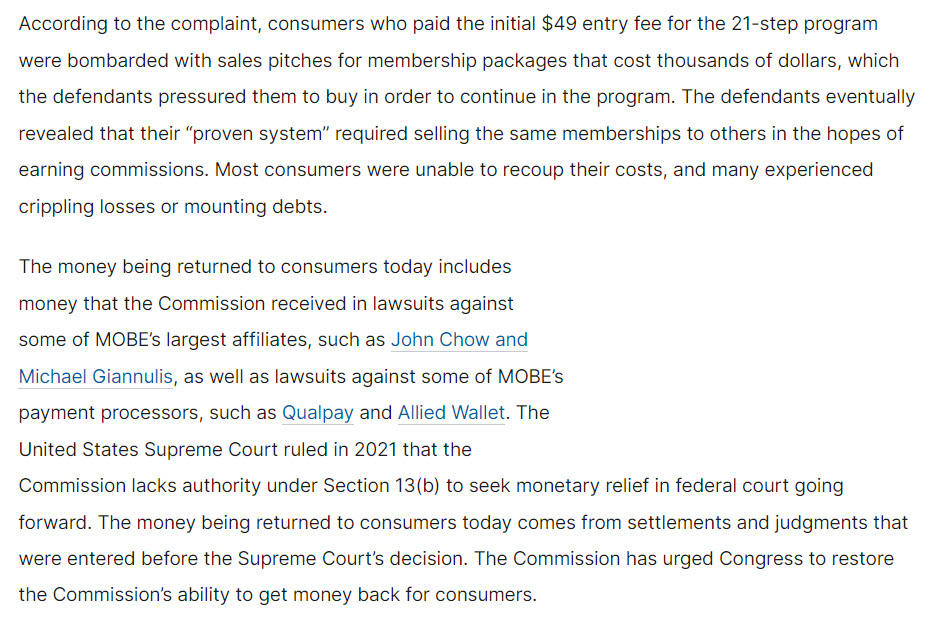

MOBE’s trajectory took a decisive turn when the Federal Trade Commission (FTC) intervened, unmasking the scheme’s deceptive nature and initiating legal actions against the organization and its key players. The FTC’s involvement highlighted the gravity of MOBE’s transgressions and was a cautionary tale in online business education.

Timeline of FTC Actions Against MOBE:

| Date | Action |

| June 2018 | The FTC filed a complaint against MOBE, citing deceptive practices. |

| June 2018 | A temporary restraining order was issued, halting MOBE’s operations. |

| August 2018 | The FTC settled with Matt Lloyd, banning him from operating or participating in specific business ventures. |

| June 2019 | The court-appointed receiver began the process of reimbursing victims. |

Legal Consequences and Penalties:

- Monetary Penalties: As part of the settlement, monetary penalties were imposed on MOBE and its key figures.

- Ban on Operations: MOBE faced a ban on its operations, preventing the continuation of its deceptive business model.

- Restitution for Victims: The court-ordered restitution aimed to compensate victims who suffered financial losses due to their involvement with MOBE.

The legal actions against MOBE underscored the severe nature of pyramid schemes. They served as a stark reminder of the potential consequences awaiting those who engage in deceptive practices within the online business education domain. The aftermath of the FTC’s intervention emphasized the need for heightened vigilance and regulatory measures to protect consumers from such schemes.

III. Legendary Marketer (please note we are not reviewing the produt itself but rather the business model)

A. Company Overview

Genesis of Legendary Marketer: Legendary Marketer, founded by David Sharpe, burst onto the online business education scene with promises of transforming aspiring entrepreneurs into marketing legends. Launched in 2016, the company positioned itself as a comprehensive platform offering digital marketing training, mentorship, and income-generating opportunities.

Mission and Approach: Legendary Marketer aimed to empower individuals with the skills and knowledge necessary to thrive in the digital business landscape. Its approach centered on providing educational resources and opportunities to earn income through affiliate marketing.

B. Marketing Tactics Employed

Aggressive Digital Marketing: Legendary Marketer gained attention not only for its educational offerings but also for its aggressive digital marketing tactics. The company employed various online channels to reach a broad audience, including social media, email marketing, and webinars.

Emphasis on High-Income Potential: One of the standout features of Legendary Marketer’s marketing strategy was its emphasis on the high-income potential for participants. The company positioned its training as a gateway to financial success, leveraging success stories and testimonials to entice individuals into its programs.

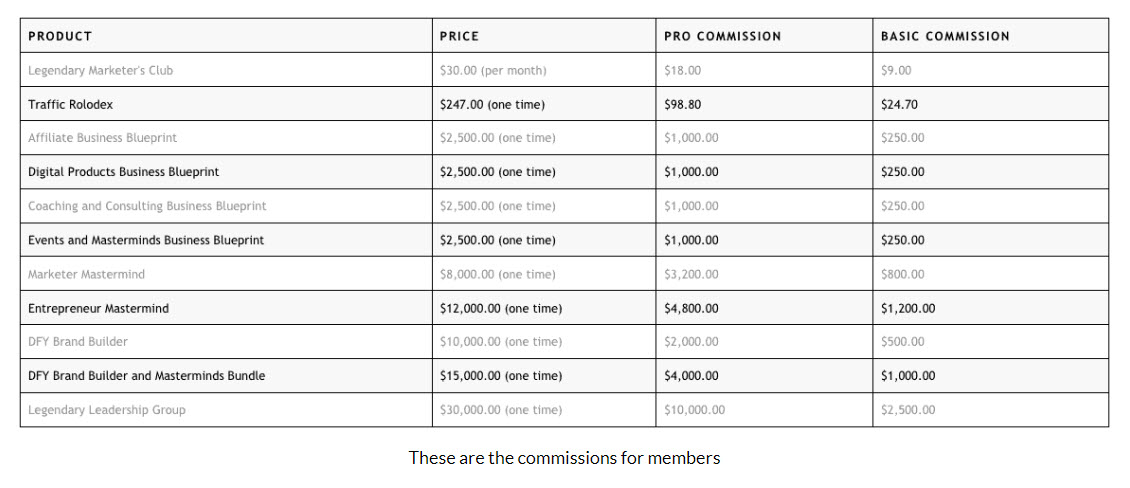

C. Compensation Structure

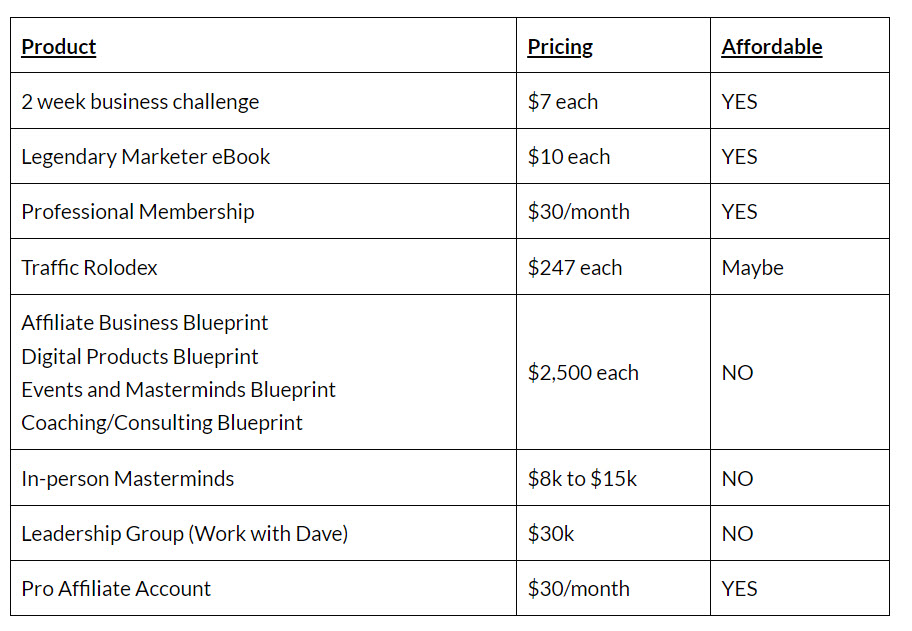

Affiliate Marketing Model: Legendary Marketer operated on an affiliate marketing model, allowing participants to earn commissions by promoting and selling the company’s educational products. The compensation structure incentivized individuals to consume the training and recruit new members into the program.

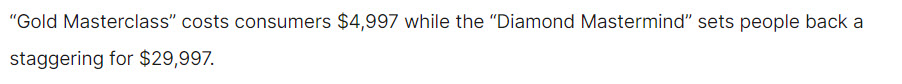

Tiered Membership Levels: Participants could access different membership levels, each offering varying levels of training and commission potential. The tiered structure encouraged participants to upgrade their memberships, promising higher commissions and exclusive benefits with each level.

D. Consumer Complaints and Regulatory Actions

Consumer Complaints: Despite the allure of high-income potential, Legendary Marketer faced many consumer complaints. These complaints often revolved around the marketing tactics employed by the company, with some individuals expressing dissatisfaction with the actual value received relative to the promises made.

Regulatory Scrutiny: While not every MLM (Multi-Level Marketing) or pyramid-like scheme faces legal consequences, heightened scrutiny from regulatory bodies prompted investigations into Legendary Marketer’s practices. Such investigations aimed to assess the company’s compliance with consumer protection laws and standards for ethical business conduct.

IV. The 4 Percent Group (please note we are not reviewing the produt itself but rather the business model)

A. Overview of the Group

Genesis and Mission: The 4 Percent Group, led by Vick Strizheus, positioned itself as a digital marketing and entrepreneurial training platform. Launched with the promise of guiding individuals to achieve a level of success that would place them in the top 4% of online entrepreneurs, the group aimed to provide a comprehensive suite of resources for aspiring digital marketers.

Educational Focus: The 4 Percent Group purportedly offered training programs and resources covering various aspects of online marketing, sales funnels, and entrepreneurship. The group’s mission was to empower members with the skills and knowledge needed to succeed in the competitive digital landscape.

B. Income Claims and Promises

Bold Income Claims: One of the hallmarks of The 4 Percent Group’s marketing strategy was its bold income claims. Participants were enticed with promises of substantial earnings, often portrayed as achievable by implementing the group’s training and marketing strategies.

Unrealistic Profit Projections: The group’s promotional materials and presentations frequently showcased individuals claiming significant financial success due to their affiliation with The 4 Percent Group. These profit projections, however, were often unrealistic and created a sense of urgency among potential recruits.

C. Recruitment Strategies

Emphasis on Affiliate Marketing: Like other online business education platforms, The 4 Percent Group heavily emphasized affiliate marketing as a primary avenue for income generation. Participants were encouraged to consume the group’s training and recruit others into the program, expanding their downline.

Tiered Membership Levels: The recruitment strategy of The 4 Percent Group involved a tiered membership structure, with participants having the option to upgrade their memberships for access to higher-level training and supposedly increased income potential. This tiered approach incentivized individuals to recruit new members to enhance their earning capabilities.

D. Legal Implications and FTC Involvement

FTC Scrutiny: The 4 Percent Group, like MOBE and Legendary Marketer, faced regulatory scrutiny from the Federal Trade Commission (FTC). The FTC, tasked with protecting consumers from deceptive business practices, initiated investigations to assess the group’s compliance with consumer protection laws.

Legal Consequences: Legal implications for The 4 Percent Group would depend on the outcomes of any investigations or actions taken by regulatory authorities. Such consequences might include fines, restitution for affected individuals, and potential restrictions on the group’s operations.

V. How Pyramid Schemes Work

A. Recruitment-Focused Structure

Recruitment as the Cornerstone: At the heart of pyramid schemes lies a recruitment-focused structure that places paramount importance on enlisting new participants. Participants are not primarily compensated for selling tangible products or services but for recruiting others into the scheme. This hierarchical recruitment system creates a pyramid-shaped structure, with the focus shifting from product value to expanding the network of participants.

Pyramid Scheme Recruitment Structure

| Level | Description |

| Level 1 | Original recruiter (top of the pyramid) |

| Level 2 | Individuals recruited by Level 1 |

| Level 3 | Individuals recruited by Level 2, and so on |

| … | The pyramid continues to expand exponentially. |

- Lack of Tangible Products or Services

Absence of Genuine Value: In pyramid schemes, the emphasis on recruitment often overshadows the sale of legitimate products or services. While some schemes may introduce products, these are frequently of dubious value or overpriced, serving as a facade to legitimize the operation. The primary revenue driver continues to recruit new participants rather than create or distribute worthwhile offerings.

Lack of Tangible Products or Services

| Aspect | Description |

| Product Value | Minimal or questionable value of products or services offered. |

| Price Structure | Products may be overpriced to generate revenue for the scheme. |

| Genuine Transactions | Limited genuine transactions involving valuable products or services. |

C. Unsustainable Financial Models

Promise of Exponential Returns: Pyramid schemes entice participants with promises of exponential financial gains. The compensation structure is designed to give the illusion of substantial returns through recruitment efforts. However, this economic model is inherently unsustainable, relying on an ever-expanding base of recruits to fund the earnings promised to those higher in the pyramid.

Unsustainable Financial Models

| Characteristic | Description |

| Recruitment Dependency | The scheme relies on continuous recruitment to sustain earnings. |

| Financial Impossibility | The exponential growth required for returns is financially unattainable. |

| Inevitable Collapse | An unsustainable model leads to the eventual collapse of the scheme. |

D. Consumer Risks and Losses

Financial Vulnerability: Participants in pyramid schemes face inherent risks, primarily economic. The unsustainable structure ensures that only a few participants can achieve the promised earnings, leaving the majority at a financial loss. As the pyramid collapses, those lower in the hierarchy bear the brunt of the economic consequences.

Consumer Risks and Losses

| Risk Factor | Description |

| Financial Losses | Participants, especially those lower in the pyramid, incur losses. |

| Illusion of Prosperity | Initial gains for some participants create a false sense of prosperity. |

| Legal Consequences | Regulatory actions may lead to legal consequences for participants. |

Understanding the mechanics of pyramid schemes is crucial for individuals to recognize the red flags and protect themselves from falling prey to deceptive recruitment practices. The recruitment-focused structure, lack of genuine products, unsustainable financial models, and potential consumer risks are vital elements that characterize the workings of pyramid schemes.

VI. FTC Complaints and Legal Actions

A. Role of the Federal Trade Commission

Consumer Protection Oversight: The Federal Trade Commission (FTC) plays a pivotal role in safeguarding consumers from deceptive and fraudulent business practices. As the primary federal agency responsible for enforcing consumer protection laws, the FTC monitors various industries, investigates potential violations, and takes legal action against entities engaging in unfair or deceptive practices.

Enforcement of Antipyramid Scheme Laws: The FTC enforces laws within pyramid schemes to prevent fraudulent multilevel marketing (MLM) structures. The agency intervenes to protect individuals from schemes prioritizing recruitment over the sale of legitimate products or services, posing financial risks to participants.

B. Typical Complaints Against Pyramid Schemes

Misleading Income Claims: Consumer complaints against pyramid schemes frequently revolve around misleading income claims. Enticed by promises of substantial earnings, participants often find these claims unrealistic and unattainable, leading to financial disappointment.

Lack of Product Value: Complaints also highlight the lack of tangible product value in pyramid schemes. Participants may express dissatisfaction with overpriced or low-quality products that serve as a facade for recruitment-focused operations.

Recruitment Pressures: Pyramid schemes often employ aggressive recruitment tactics, leading to complaints about the pressure placed on participants to recruit new members. This aspect is often central to the deceptive nature of these schemes.

C. Legal Consequences and Penalties

Monetary Penalties: When pyramid schemes face legal actions, one common consequence is the imposition of financial penalties. Fines may be levied against the entities involved, with the funds often allocated towards restitution for affected participants.

Injunctions and Cease-and-Desist Orders: The FTC can seek injunctions and cease-and-desist orders against pyramid schemes, restraining them from engaging in specific activities or requiring them to cease operations altogether. These orders aim to prevent further harm to consumers.

Restitution for Victims: Legal actions against pyramid schemes may include provisions for restitution to victims. This involves compensating individuals who suffered financial losses due to their involvement with the scheme.

Ban on Operations: In severe cases, legal consequences may involve a complete ban on the operations of the pyramid scheme. This action aims to shut down deceptive practices and protect consumers from further harm.

Individual Liability: Legal actions may extend to individuals orchestrating or promoting pyramid schemes. This includes founders, executives, and high-level participants who may face personal liability, fines, or restrictions on future business activities.

Legal Consequences and Penalties

| Legal Action | Description |

| Monetary Penalties | Fines imposed on the pyramid scheme and individuals involved. |

| Injunctions and Orders | Court orders restrict specific activities or mandate the cessation of operations. |

| Restitution for Victims | Compensation is allocated to individuals who suffered financial losses. |

| Ban on Operations | Prohibition of the pyramid scheme’s continued operations. |

| Individual Liability | Legal consequences extend to individuals involved in the scheme. |

Understanding the role of the FTC, typical consumer complaints, and potential legal consequences sheds light on the efforts made to curb deceptive pyramid schemes and protect consumers from financial exploitation. The combination of regulatory oversight and legal actions contributes to a more vigilant and accountable landscape for online business opportunities.

VII. Signs of Pyramid Schemes

A. Emphasis on Recruitment over Product Sales

Primary Focus on Recruitment: One of the clear signs of a pyramid scheme is the disproportionate emphasis on recruitment as the primary source of income. Instead of generating revenue by selling genuine products or services, participants earn mainly by bringing in new members. The hierarchical structure, resembling a pyramid, highlights the priority placed on building a network rather than delivering value.

Emphasis on Recruitment

| Aspect | Description |

| Recruitment Dependency | The primary focus is on recruiting new members to sustain earnings. |

| Hierarchical Structure | Distinct levels within the structure indicate a recruitment-centric model. |

| Minimal Product Sales | Lack of emphasis on genuine product sales as a revenue source. |

B. Exaggerated Income Claims

Unrealistic Financial Promises: Pyramid schemes often lure participants with exaggerated income claims, promising substantial earnings with minimal effort. These claims create a false sense of financial prosperity, enticing individuals to join with the expectation of quick and significant returns.

Exaggerated Income Claims

| Characteristic | Description |

| Unrealistic Earning Claims | Promises of extravagant income with minimal effort or investment. |

| Lack of Realistic Foundation | Income projections lack a credible basis or sustainable financial model. |

| High-Pressure Sales Tactics | Use of aggressive marketing to create a sense of urgency and exclusivity. |

C. Lack of Genuine Product Value

Questionable Products or Services: In pyramid schemes, products or services are often secondary and may lack genuine value. The primary function of these offerings is to provide a facade of legitimacy to the scheme. Participants may find that the products are overpriced or of minimal utility, serving to justify recruitment-focused operations.

Lack of Genuine Product Value

| Aspect | Description |

| Overpriced or Low Quality | Products offered lack value or are priced higher than their worth. |

| Facade for Legitimacy | Products serve as a cover to legitimize the recruitment-centric model. |

| Limited Consumer Demand | Products lack genuine demand or utility outside the scheme. |

D. High Upfront Costs and Membership Fees

Financial Barriers to Entry: Pyramid schemes often require high upfront costs or membership fees. These fees contribute to the revenue stream of the scheme and are positioned as investments that will yield lucrative returns. However, the primary purpose is to generate income for existing participants by recruiting new members.

High Upfront Costs and Membership Fees

| Aspect | Description |

| High Initial Investment | Participants are required to make substantial upfront payments. |

| Membership Tiers | Tiered membership levels with increasing costs for perceived benefits. |

| Focus on Recruiting New Members | Fees serve as a means to fund earnings for existing participants. |

Recognizing these signs is essential for individuals to protect themselves from falling victim to deceptive pyramid schemes. An awareness of the emphasis on recruitment, exaggerated income claims, lack of genuine product value, and high upfront costs can serve as valuable tools in identifying and avoiding potentially harmful schemes.

VIII. Consumer Protection and Awareness

A. Educating Consumers about Pyramid Schemes

Public Awareness Campaigns: Consumer education is vital to protecting individuals from pyramid schemes. Public awareness campaigns conducted by government agencies, consumer advocacy groups, and educational institutions aim to inform the public about the deceptive nature of pyramid schemes. These campaigns often provide resources, guidelines, and red flags to help individuals distinguish legitimate opportunities from fraudulent schemes.

Workshops and Seminars: Educational workshops and seminars offer a more interactive platform for consumers to learn about pyramid schemes. These sessions delve into the mechanics of deceptive schemes, highlight common tactics fraudsters use, and empower participants with the knowledge needed to make informed decisions about potential business opportunities.

B. Reporting Suspicious Activities to the FTC

FTC Complaint Process: Empowering consumers to report suspicious activities is crucial in combating pyramid schemes. The Federal Trade Commission (FTC) allows individuals to submit complaints online, reporting potential fraudulent practices. The FTC uses these complaints to gather information, investigate deceptive activities, and take legal action against entities engaging in pyramid schemes.

Anonymous Reporting: Recognizing the sensitivity of reporting fraud, the FTC allows individuals to submit complaints anonymously. This provision encourages those who may be hesitant due to fear of retaliation or other concerns to come forward and contribute to efforts to curb deceptive practices.

Reporting Suspicious Activities to the FTC

| Aspect | Description |

| FTC Complaint Process | Individuals can file complaints online through the FTC’s official website. |

| Anonymous Reporting | Option for consumers to submit complaints anonymously for added protection. |

| Information Gathering | The FTC uses consumer complaints to gather evidence and investigate deceptive activities. |

C. Legal Rights and Options for Victims

Access to Legal Assistance: Individuals who have fallen victim to pyramid schemes have legal rights and options for recourse. Legal aid services, pro bono legal clinics, and consumer protection organizations can assist victims, helping them understand their rights and explore potential legal actions.

Class Action Lawsuits: In cases where multiple individuals have suffered financial losses due to a standard pyramid scheme, lawsuits may be initiated. These lawsuits allow victims to collectively seek restitution, holding the responsible entities accountable for their deceptive practices.

Restitution and Compensation: Victims of pyramid schemes may be entitled to restitution or compensation. Legal actions taken by authorities, such as the FTC, may result in court-ordered restitution for affected individuals. Additionally, pursuing legal avenues independently can help victims seek compensation for their losses.

Legal Rights and Options for Victims

| Aspect | Description |

| Access to Legal Assistance | Legal aid services and consumer protection organizations offer support to victims. |

| Class Action Lawsuits | Victims can participate in class action lawsuits for collective action. |

| Restitution and Compensation | Legal actions may result in court-ordered restitution for victims. |

Empowering consumers with knowledge, providing avenues for reporting suspicious activities, and ensuring legal recourse for victims are essential components of a robust consumer protection framework. Through education and collaborative efforts, individuals can navigate the complex landscape of online opportunities with greater awareness and resilience against deceptive practices.

IX. Case Studies

A. Analyzing Specific Cases of Individuals Affected by MOBE, Legendary Marketer, and the 4 Percent Group

MOBE Case Study: Numerous individuals reported significant financial losses in the MOBE case. Participants invested substantial sums into the program with the expectation of high returns. However, when the FTC intervened, MOBE faced legal consequences, leading to the shutdown of its operations and financial repercussions for both the organization and its participants.

Legendary Marketer Case Study: There have been documented Instances within Legendary Marketer where participants faced challenges in achieving the promised income levels. The aggressive marketing tactics and emphasis on recruitment led to a disparity between expectations and reality for some participants. Legal scrutiny prompted a reevaluation of the company’s practices.

The 4 Percent Group Case Study: The 4 Percent Group also encountered legal issues and FTC scrutiny. Participants reported financial losses due to the recruitment-centric nature of the group’s model. Legal actions led to penalties, injunctions, and efforts to provide restitution to affected individuals.

B. Impact on Participants’ Finances and Experiences

Financial Losses: Participants suffering significant financial losses are expected across these case studies. The high upfront costs, recruitment pressures, and unrealistic income promises contributed to economic vulnerabilities, particularly for those lower in the hierarchical structure.

Emotional and Psychological Toll: Participants often experienced emotional distress and psychological impact. The disparity between promised success and actual outcomes, coupled with the realization of being part of a deceptive scheme, took a toll on participants’ well-being and confidence.

Recovery Challenges: Recovering from the financial setbacks proved challenging for many affected individuals. Some faced difficulties in reclaiming their initial investments, and the collapse of these schemes led to a loss of trust in online business opportunities for some victims.

C. Lessons Learned from Real-Life Examples

Vigilance and Due Diligence: Real-life examples underscore the importance of vigilance and due diligence when exploring online business opportunities. Conducting thorough research, questioning exaggerated claims, and critically evaluating recruitment-centric models can help individuals avoid falling victim to deceptive schemes.

Regulatory Awareness: Understanding the role of regulatory bodies, such as the FTC, is crucial. Awareness of legal consequences for pyramid schemes can serve as a deterrent and empower individuals to report suspicious activities, contributing to the protection of themselves and others.

Consumer Education: The impact on participants in these cases emphasizes the need for ongoing consumer education. Educating individuals about the hallmarks of pyramid schemes, highlighting the risks associated with recruitment-focused models, and promoting financial literacy can build resilience against deceptive practices.

Community Support: Real-life examples highlight the importance of community support for victims. Initiatives that provide legal assistance, counseling, and resources for recovery can aid individuals affected by pyramid schemes in navigating the aftermath.

Individuals can gain insights into the real-world consequences of involvement with deceptive schemes by analyzing specific cases. These case studies serve as cautionary tales, emphasizing the significance of informed decision-making and the collective effort required to protect consumers from fraudulent practices.

X. Red Flags for Identifying Pyramid Schemes

A. Unreasonable Income Claims and Guarantees

Exaggerated Promises: One of the most prominent red flags for identifying a pyramid scheme is the presentation of unreasonable income claims and guarantees. Schemes often promise participants extravagant earnings with minimal effort, creating an illusion of financial success that is neither realistic nor sustainable.

Unreasonable Income Claims and Guarantees

| Aspect | Description |

| Unrealistic Earning Claims | Promises of extravagant income with minimal effort or investment. |

| Lack of Supporting Evidence | Claims lack verifiable evidence or a realistic foundation. |

| Guarantee of High Returns | Assurances of guaranteed high returns without inherent risks. |

B. Lack of Transparency in Business Operations

Opaque Business Practices: Pyramid schemes frequently operate with a lack of transparency in their business operations. Information about the structure, financial models, and product value may be intentionally obscured. Genuine businesses prioritize transparency, whereas deceptive schemes thrive on keeping participants in the dark.

Lack of Transparency in Business Operations

| Aspect | Description |

| Concealed Business Structure | Lack of clarity on the hierarchical structure and operations. |

| Ambiguous Product Information | Insufficient details about products or services offered. |

| Limited Access to Information | Participants are denied access to critical business information. |

C. Focus on Recruitment as the Primary Source of Income

Recruitment-Centric Model: A clear red flag is the emphasis on recruitment as the primary source of income. In legitimate business models, revenue is generated by selling genuine products or services. In pyramid schemes, recruitment takes precedence, with participants earning primarily through bringing in new members.

Focus on Recruitment

| Aspect | Description |

| Recruitment Dependency | The primary focus is on recruiting new members to sustain earnings. |

| Hierarchical Structure | Distinct levels within the structure indicate a recruitment-centric model. |

| Minimal Product Sales | Lack of emphasis on genuine product sales as a revenue source. |

D. Pressure Tactics and Emotional Manipulation in Sales Pitches

High-Pressure Sales Strategies: Pyramid schemes often employ pressure tactics and emotional manipulation in their sales pitches. Participants may be subjected to urgency, exclusivity, and fear of missing out to compel quick decisions. Genuine opportunities prioritize informed decision-making over high-pressure tactics.

Pressure Tactics and Emotional Manipulation

| Aspect | Description |

| Urgency and Exclusivity | High-pressure strategies to create a sense of urgency and exclusivity. |

| Emotional Manipulation | Use of emotional triggers to influence decision-making. |

| Lack of Informed Consent | Participants may make decisions under duress or without complete information. |

Identifying these red flags is crucial for individuals to protect themselves from pyramid schemes. Being vigilant, asking critical questions, and seeking transparency can help distinguish legitimate opportunities from deceptive schemes.

XI. Legal Landscape Surrounding Pyramid Schemes

A. Relevant Laws and Regulations Governing MLMs and Pyramid Schemes

FTC Guidelines: The Federal Trade Commission (FTC) provides guidelines and regulations to distinguish legitimate multilevel marketing (MLM) operations from deceptive pyramid schemes in the United States. The FTC Act prohibits unfair and deceptive practices, offering a legal framework for intervention and prosecution.

Anti-Pyramid Scheme Laws: Several states have enacted specific laws to complement federal regulations. These laws define the characteristics of pyramid schemes, establish criteria for legal MLMs, and empower regulatory authorities to take legal action against deceptive schemes.

Securities Laws: In cases where pyramid schemes involve the sale of investment opportunities, securities laws may come into play. The Securities and Exchange Commission (SEC) oversees the enforcement of federal securities laws, ensuring compliance and protecting investors from fraudulent investment schemes.

B. Changes in Legislation to Address Evolving Online Schemes

Digital Economy Act: As online opportunities evolve, legislative bodies adapt to address new challenges worldwide. In the UK, the Digital Economy Act empowers regulatory bodies to tackle online fraud, including deceptive marketing practices and pyramid schemes conducted through digital platforms.

Focus on Consumer Protections: Legislation often evolves to strengthen consumer protections. Recent changes may include provisions that enhance transparency requirements for online business opportunities, ensure more transparent disclosures, and provide authorities with more tools to combat deceptive practices in the digital space.

- International Cooperation in Combating Cross-Border Pyramid Schemes

Cross-Border Challenges: Pyramid schemes often transcend national borders, making international cooperation crucial in combating their global reach. Regulatory bodies and law enforcement agencies collaborate to share information, coordinate investigations, and effectively develop strategies to address cross-border pyramid schemes.

International Frameworks: International organizations, such as the International Consumer Protection and Enforcement Network (ICPEN), facilitate cooperation among consumer protection authorities worldwide. Agreements and frameworks are established to streamline the exchange of information and enforcement actions against entities engaged in deceptive practices.

Global Regulatory Harmonization: Efforts are underway to harmonize regulatory approaches globally. This involves aligning legal definitions, standards, and enforcement mechanisms to create a unified front against pyramid schemes that exploit jurisdictional variations.

Understanding the legal landscape surrounding pyramid schemes involves recognizing the evolving nature of online opportunities and the need for coordinated efforts to protect consumers globally. Legal frameworks aim to balance fostering legitimate business activities and safeguarding individuals from deceptive practices in the rapidly evolving digital economy.

XII. Strategies for Consumer Protection

A. Strengthening Awareness Campaigns Against Pyramid Schemes

Public Education Initiatives: Robust awareness campaigns are essential to enhance consumer protection. Government agencies, consumer advocacy groups, and industry associations can collaborate to develop comprehensive public education initiatives. These campaigns aim to inform individuals about the red flags of pyramid schemes, empower them to make informed decisions and raise awareness about reporting mechanisms.

Strengthening Awareness Campaigns

| Initiative | Description |

| Educational Workshops | Conducting workshops to educate the public about pyramid schemes. |

| Online Resources | Providing accessible online resources with information on red flags. |

| Media Partnerships | Collaborating with media outlets for broader dissemination of awareness messages. |

B. Collaboration Between Government Agencies, Industry, and Consumer Advocacy Groups

Cross-Sector Collaboration: Effective consumer protection requires collaboration across government agencies, industry stakeholders, and consumer advocacy groups. Joint efforts can include sharing information, coordinating enforcement actions, and establishing standards for ethical business conduct.

Cross-Sector Collaboration

| Collaborative Action | Description |

| Information Sharing | Establishing mechanisms for sharing information on deceptive schemes. |

| Task Forces and Working Groups | Forming collaborative task forces to address emerging challenges. |

| Industry Self-Regulation | Encouraging industry stakeholders to adopt and enforce self-regulatory measures. |

C. Enhancing Online Platforms’ Responsibility in Preventing the Promotion of Fraudulent Schemes

Platform Accountability: Online platforms play a pivotal role in preventing the promotion of fraudulent schemes. Collaborative efforts between regulators, platforms, and industry associations can establish clear guidelines, policies, and reporting mechanisms to swiftly identify and take down pyramid schemes.

Enhancing Online Platforms’ Responsibility

| Key Measures | Description |

| Clear Policies and Guidelines | Platforms implementing clear policies against fraudulent promotions. |

| Reporting Mechanisms | Establishing user-friendly reporting mechanisms for deceptive content. |

| Collaboration with Regulators | Platforms collaborating with regulatory bodies to address emerging threats. |

Collectively, these strategies contribute to a comprehensive approach to consumer protection. By strengthening awareness, fostering collaboration, and holding online platforms accountable, stakeholders can create an environment that is less susceptible to pyramid schemes, ultimately safeguarding individuals from financial exploitation and deceptive practices.

XIII. Alternatives to Pyramid Schemes

A. Promoting Legitimate Business Opportunities

Focus on Ethical MLMs: Promoting legitimate multilevel marketing (MLM) opportunities that adhere to ethical business practices is an alternative to pyramid schemes. Ethical MLMs prioritize selling genuine products or services, offering participants a chance to earn through legitimate sales rather than recruitment.

Promoting Legitimate Business Opportunities

| Aspect | Description |

| Genuine Products or Services | Emphasis on MLMs with valuable products or services at the core. |

| Transparent Compensation | Clear compensation structures based on actual sales rather than recruitment. |

| Proven Track Record | Highlighting MLMs with a history of ethical business conduct. |

B. Encouraging Entrepreneurship with Proven Models

Support for Established Entrepreneurial Models: Encouraging individuals to explore entrepreneurship through established and proven models provides a legitimate path to financial independence. This could involve promoting traditional business ventures, franchise opportunities, or well-established online business models.

Encouraging Entrepreneurship

| Model Type | Description |

| Traditional Business Ventures | Support for individuals starting businesses with proven success models. |

| Franchise Opportunities | Encouraging entrepreneurship through established franchise models. |

| Online Business Models | Promoting legitimate online business opportunities with proven track records. |

C. Resources for Individuals Seeking Genuine Income Opportunities

Educational and Training Resources: Providing resources for individuals seeking genuine income opportunities involves offering educational materials, training programs, and mentorship. Access to information on building valuable skills and understanding legitimate business practices can empower individuals to make informed choices.

Resources for Genuine Income Opportunities

| Resource Type | Description |

| Educational Materials | Resources offering information on legitimate business practices. |

| Training Programs | Access to training programs that enhance skills for entrepreneurship. |

| Mentorship Initiatives | Connecting individuals with mentors in established business sectors. |

Encouraging alternatives to pyramid schemes involves fostering a culture of ethical business practices, promoting established entrepreneurial models, and providing resources for skill development. By focusing on legitimate opportunities, individuals can pursue avenues that align with ethical standards and contribute to their long-term success.

XIV. Continued Challenges and Evolving Tactics

A. Adaptations Made by Pyramid Schemes to Avoid Detection

Digital Sophistication: Pyramid schemes continuously evolve their tactics to avoid detection by authorities and consumers. Digital sophistication, including advanced online platforms, encrypted communication, and pseudonymous identities, makes it challenging for regulatory bodies to identify and track deceptive operations effectively.

Adaptations by Pyramid Schemes

| Adaptation | Description |

| Cryptocurrencies | Utilizing cryptocurrencies for transactions to obfuscate financial trails. |

| Online Anonymity | Operating under pseudonyms and concealing identities to evade scrutiny. |

| Dynamic Digital Platforms | Utilizing rapidly changing online platforms to stay ahead of enforcement efforts. |

B. Emerging Trends in Online Fraud and Deception

Use of Social Media Platforms: Pyramid schemes increasingly leverage popular social media platforms for recruitment and promotion. The accessibility and global reach of these platforms provide fraudsters with an expansive audience, making it challenging for regulators to monitor and control deceptive activities effectively.

Influencer Marketing: Emerging trends include influencer marketing to lend an air of legitimacy to pyramid schemes. Influencers, knowingly or unknowingly, may promote deceptive schemes to their followers, amplifying the reach of fraudulent operations.

Emerging Trends in Online Fraud

| Trend | Description |

| Social Media Recruitment | Utilizing popular social media platforms for recruitment and promotion. |

| Influencer Involvement | Leveraging influencers to endorse or promote deceptive schemes. |

| Exploitation of Online Trends | Adapting strategies to align with trending topics and online behaviors. |

C. Challenges Faced by Regulatory Bodies in Keeping Up with Evolving Schemes

Global and Cross-Border Nature: The international and cross-border nature of online schemes poses challenges for regulatory bodies. Coordinating efforts across jurisdictions becomes intricate as schemes operate seamlessly across national boundaries.

Rapid Proliferation: The rapid proliferation of new online opportunities requires regulatory bodies to stay agile and adapt swiftly to emerging threats. The sheer volume of schemes demands proactive measures to identify and intervene before significant harm occurs.

Challenges for Regulatory Bodies

| Challenge | Description |

| Cross-Border Coordination | There is a need for effective collaboration among regulatory bodies worldwide. |

| Agility in Response | The ability to adapt quickly to new and evolving deceptive tactics. |

| Resource Constraints | Limited resources for monitoring and addressing a vast number of schemes. |

Addressing continued challenges and evolving tactics requires a dynamic and collaborative approach. Regulatory bodies must enhance their technological capabilities, strengthen international cooperation, and adopt proactive strategies to avoid deceptive schemes in the fast-paced digital landscape.

XV. Conclusion

A. Recap of Key Points Discussed

In this comprehensive exploration of pyramid schemes and deceptive online practices, several key points have emerged:

- Definition and Characteristics: Pyramid schemes are deceptive business models prioritizing recruitment over genuine product sales, posing financial risks to participants.

- Case Studies: Examining specific cases of MOBE, Legendary Marketer, and The 4 Percent Group highlighted the financial losses, emotional toll, and legal consequences faced by individuals involved in such schemes.

- Consumer Protection Strategies: Strengthening awareness campaigns, promoting stakeholder collaboration, and holding online platforms accountable are crucial for protecting consumers.

- Alternatives to Pyramid Schemes: Encouraging legitimate business opportunities and providing resources for genuine income opportunities offer viable alternatives to deceptive schemes.

- Legal Landscape: Understanding relevant laws, changes in legislation, and international cooperation is essential for creating a robust legal framework to combat pyramid schemes.

- Challenges and Evolving Tactics: Ongoing challenges include the adaptability of pyramid schemes to avoid detection, emerging trends in online fraud, and the difficulties regulatory bodies face in keeping pace with evolving schemes.

B. Importance of Vigilance and Due Diligence in Evaluating Online Opportunities

As the digital landscape continues evolving, vigilance and due diligence cannot be overstated. Individuals must approach online opportunities with a critical mindset, questioning unrealistic income claims, evaluating transparency in business operations, and recognizing red flags associated with pyramid schemes. The evolving tactics employed by fraudulent schemes necessitate an ongoing commitment to staying informed and discerning.

C. Empowering Consumers to Make Informed Choices and Avoid Falling Victim to Scams

Empowering consumers is at the heart of adequate protection against pyramid schemes. Through education, awareness campaigns, and accessible resources, consumers can develop the skills and knowledge needed to make informed choices. Recognizing the role of regulatory bodies, industry collaboration, and personal responsibility, individuals can confidently navigate the online landscape, avoiding scams and contributing to a safer digital economy.

In conclusion, the fight against pyramid schemes requires a collective effort. By staying vigilant, fostering awareness, and empowering consumers, we can build a resilient defense against deceptive practices, ultimately creating a digital environment where legitimate opportunities flourish and individuals are protected from financial exploitation.