2025 AI Recession – How To Prepare!

How to Navigate the Upcoming AI-Driven Recession and Thrive Financially

Hey guys, it’s Marcus here, and today I want to talk about something BIG that no one seems to be addressing, and that’s how AI might be the driving force behind one of the biggest recessions or depressions we’ve ever seen. I know it sounds heavy, but bear with me. There’s a lot to unpack here, and more importantly, there are ways you can survive and thrive during these challenging times.

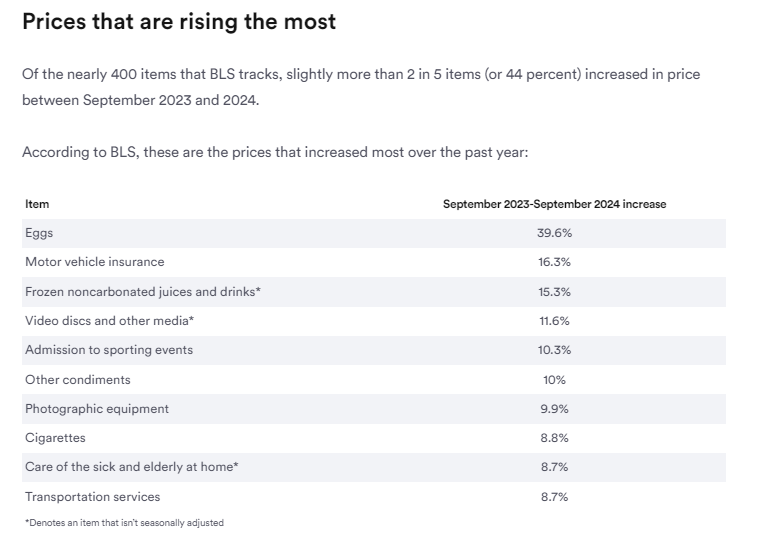

The Signs of a Looming Recession

We all know the facts: groceries are more expensive than ever, with some bags costing upwards of $125 or more. Car prices have also skyrocketed imagine paying almost $80,000 for a used 2024 Chevy Suburban! Studies show that the average household needs over $111,000 more annually to maintain the same standard of living as a few years ago. That’s mind blowing!

But there’s an elephant in the room that no one talks about: AI.

AI and Job Displacement: Are You Ready?

AI is poised to disrupt the job market in a way we’ve never seen before. If you’re like most people, there’s a chance your job is at risk, and it’s happening faster than we realize. AI doesn’t need breaks, it doesn’t get sick, and it works 24/7. How are we supposed to compete with that?

The situation could get even tougher as more advanced AI models come into play, like AGI (Artificial General Intelligence). So, what can you do when AI starts coming for your job? That’s exactly what I’m here to discuss.

Forget What You’ve Heard About Saving for a Rainy Day

Here’s the thing—most people are being told to save money, to sock it away for a rainy day, but I think that advice is completely off the mark. As FDR said during the last Great Depression, “The only thing we have to fear is fear itself.” Fear and uncertainty drive poor decision making. You need to focus on surviving this recession and finding ways to thrive. The money doesn’t just disappear—it moves hands. It is key to know where it’s going and how to get in the flow.

Economic Indicators You Should Be Paying Attention To:

One of the major indicators of a recession is the consumer confidence index. When people are scared, they stop spending. And when people stop spending, the economy grinds to a halt. Right now, we’re seeing spikes in searches like “AI jobs,” “recession,” and “inflation” on Google Trends, and those aren’t good signs.

Since the end of 2022, around the same time ChatGPT came out, people have been searching for “AI jobs” at an increasing rate, and guess what? That’s only going to grow. Companies are replacing human jobs with AI because it’s cheaper and more efficient. It’s scary, but it’s also an opportunity.

Where Does the Money Go in a Recession?

So, where does all this money go? Here’s the cold, hard truth: it moves to the wealthy. We’ve seen it time and time again. During recessions, money flows up to the top 1% and stays there. Just look at the net worth of billionaires they’ve doubled or tripled in recent years while most people struggle to make ends meet.

How You Can Get Ahead: Learn to Leverage AI

Here’s where you need to start paying attention: AI isn’t just a threat it’s also a tool. If you’re smart, you can use AI to your advantage and create new income streams. The possibilities are endless, whether you’re learning how to use AI to automate tasks, create content, or even start a new business. AI gives everyday people access to resources and skills that once required entire teams of employees.

The Real Estate Market

We’re seeing house prices drop in certain areas, and this could be another sign that a recession is coming. In Florida, for example, house prices are dropping fast. If people can’t afford to live in expensive areas, they’ll start selling their homes, which drives prices down even further. And if you think about it, this cycle happens again and again, just like it did in 2008.

Rising Defaults and Declining Consumer Confidence

It’s not just about the housing market, though. We’re seeing rising loan defaults, declining manufacturing activity, and slowing money supply, all signs of a slowdown. And here’s the kicker: we haven’t even factored AI into the equation yet. That’s where things get interesting.

How to Make Money in a Recession Using AI

So, how do you make money in this economic environment? The answer lies in skills. You need to develop recession-proof skills that AI can’t easily replace. Here are a few areas to focus on:

- Financial management: People will need advice on managing their money, and if you can offer that, you’re already ahead of the game.

- Adaptability: Those who can quickly pivot and learn new skills will survive and thrive.

- Networking: Building relationships is key in any economy, especially in a downturn.

- AI-powered tools: Learn to use AI for programming, content creation, and automation tasks. These skills will be in high demand as more companies adopt AI technologies.

I know this can all sound overwhelming, but the good news is that you can take steps right now to protect yourself and even get ahead. Whether you learn new skills, leverage AI, or start a side hustle, the opportunities are there; you just have to take them.

If you’re ready to take control of your financial future and use AI to thrive during these uncertain times, hit the like button and stay tuned. I’ve got tons of tips and strategies coming your way that you won’t want to miss.

Do you think there is a recession coming?

Tell us your thoughts below…

5 Responses to 2025 AI Recession – How To Prepare!